Business owners across the region are set to suffer from rising national insurance contributions announced in yesterday's Budget.

Chancellor Rachel Reeves revealed employers' national insurance contributions will rise from 13.8pc to 15pc from April next year, which she says will raise £25bn a year for the government.

The announcement is a devastating and potentially fatal blow for businesses, with the threshold at which firms start paying national insurance on workers' earnings also being lowered from £9,100 to £5,000.

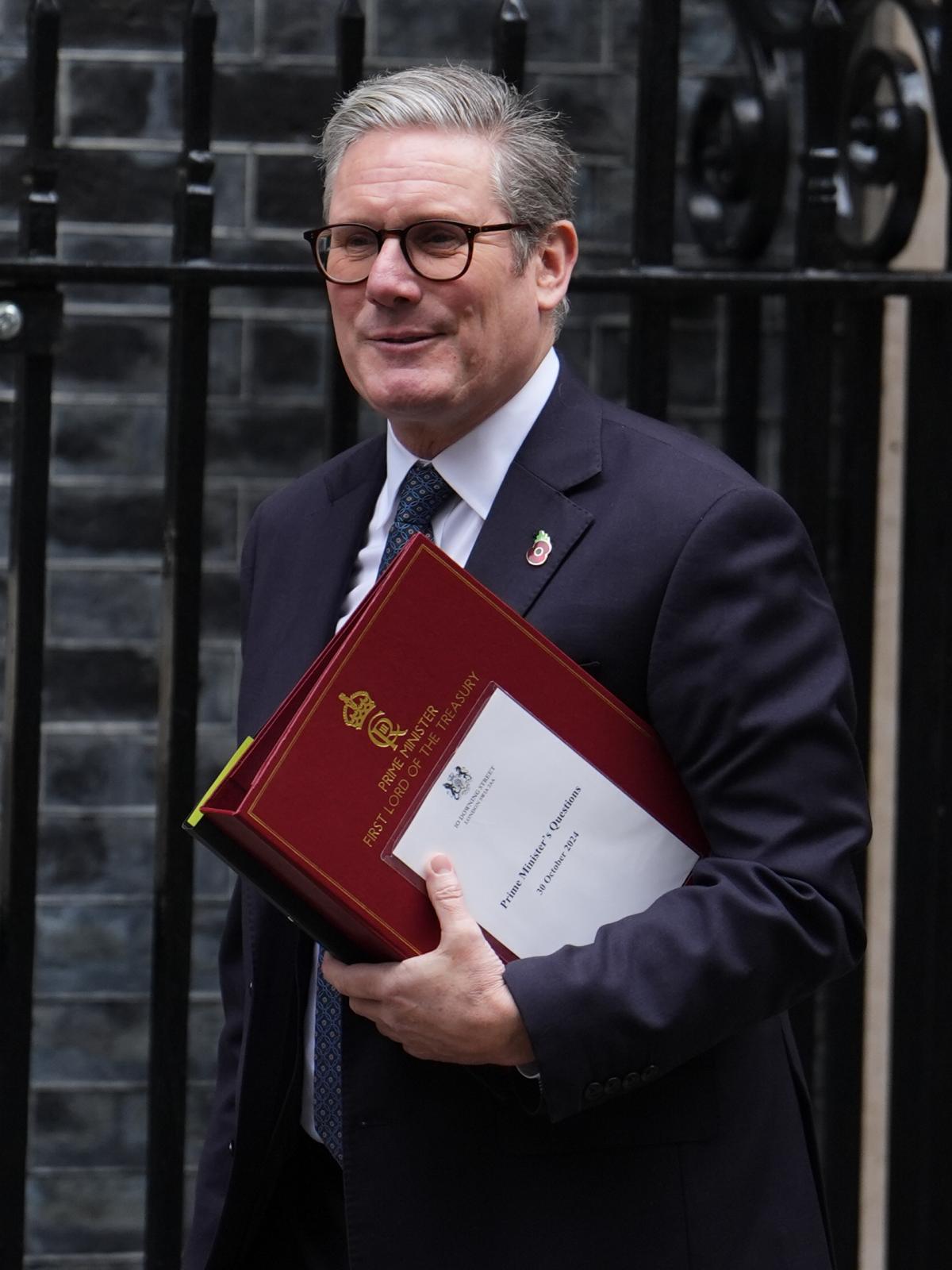

Ms Reeve's Budget - Labour's first in 14 years - will raise taxes by £40bn, which she says will help "rebuild Britain" by investing in public services like the NHS.

Employers currently pay national insurance on workers' earnings at a rate of 13.8pc, which is now set to rise by 1.2pc.

Business owners say the hike will make it harder to hire staff and create jobs.

And economists say it will have consequences for employees as the tax hike will likely be passed to staff through lower salaries and fewer pay rises.

Some claim it goes against Labour's promise to protect "working people", with Conservative Party leader Rishi Sunak saying "working people of this country will pay the price".

Employers now face a "perfect storm" of tax hikes, higher wage bills, and the cost of implementing Labour's overhaul of workers’ rights.

Nova Fairbank, chief executive of Norfolk Chambers of Commerce, said it will only "put more pressure" on businesses.

“Whilst the smallest firms will welcome the additional help that increasing the employer allowance from £5,000 to £10,500 - offsetting some of the tax pain - any business with effectively more than 15 employees will still face greater financial burden.

"There will be large number of businesses looking at the increased employer costs and seeing no option but to consider increasing their own prices to their customers."

Toby Warren, Suffolk Chambers of Commerce's senior policy officer, said the increase in employers' national insurance contributions will "hit Suffolk businesses hard" and stunt economic growth in the region, which the Labour government has pledged to deliver.

"Suffolk businesses had braced themselves for tax rises but they will still be hit them hard," he said.

"It is disappointing that the bad news was not balanced with more good news for the Suffolk economy."

"This could drive up prices and drive down wages and may lead to businesses having to make difficult decisions around jobs.

"The budget paints a mixed picture for our region’s smallest firms. Increasing the employment allowance for small businesses so significantly is a welcome move and something that FSB has consistently called for. With the rise from £5,000 to £10,500, it will shield the smallest employers from the jobs tax.

“Retail, hospitality and leisure businesses will benefit from an extension of the business rates relief, albeit at a lower level, and it is positive news that the government is committed to wider reform from 2026 onwards.

"However, the devil will be in the detail in terms of what this rate relief will be. The decision to protect small businesses from an inflationary hike in business rates – by freezing the small business multiplier – will also help small firms with premises across all sectors."

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel